EFFICIENT, RELIABLE, ACCESSIBLE – Rethinking public transit in Kamloops

By PETER TSIGARIS

Thompson Rivers University

Prelude: This editorial is part of a book series I co-authored with my senior undergraduate students, titled In the Shadow of the Hills: Socioeconomic Struggles in Kamloops, published by TRU Open Press. Chapter 3, authored by Colin Forbes, examines the state of public transportation in Kamloops and explores the systemic issues that limit its effectiveness. Below, I reflect on and summarize key insights from his research. For full details, see Chapter 3: Route Optimization: Enhancing Efficiency, Reliability, & Accessibility.

Colin Forbes.

Colin found that Kamloops’ public transportation system faces many pressing challenges. Route inefficiencies, underfunding, labour shortages, and low ridership combine to create a system that is neither accessible nor reliable enough to be a strong alternative to private vehicle use. He provides a detailed account of these systemic barriers and offers constructive ideas for reform, from improving service frequency to restructuring employment for bus drivers.

The Case for Transit Investment

Public transit produces substantial positive externalities: improved air quality, reduced traffic, and more equitable access to work and education. Yet, like many public goods, it is systematically underprovided. This is especially true when the system is inefficient. Long wait times, unreliable service, and limited routes push people toward private vehicles.

Without intervention, Kamloops is operating far below the socially optimal level of transit use. The current system serves approximately 4 million riders annually; a better-funded and more accessible network could double that. Making public transit free or more heavily subsidized, as some cities have done during peak hours, would push usage toward this target. As for low-income households, transit is not just a convenience, it is a lifeline. As Victoria Councillor Ben Isitt put it:

“I think by eliminating fares we will substantially increase the constituency and, as a result, there’ll be more political pressure for a high-quality transit system including more frequent buses and better routes,” Isitt told iNFOnews.ca. “(The goal is) to remove barriers to mobility for low-income people and to remove barriers to people getting around in a low carbon, climate-friendly way. Both those objectives, the central justice one and the environmental one, are essential.” Ben Isitt, City Council of Victoria, (Munro, 2022)

Labour Challenges and Management Failures

According to Colin a key barrier is the labour structure. Kamloops relies heavily on casual drivers, many of whom work over 100 hours per week without benefits. First Transit’s hiring model delays full-time status for new drivers, creating burnout and high turnover. This instability contributes to missed routes, late buses, and a decline in rider confidence. Even office staff are leaving, leaving drivers with no one to report issues to. Riders are frustrated. Workers are demoralized. And the system stalls.

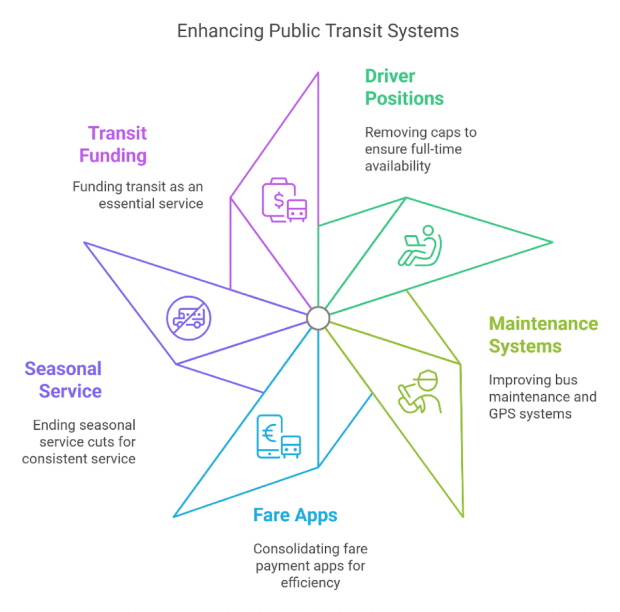

Colin outlines several pragmatic solutions:

Figure 1: Potential Solutions by Colin Forbes, Image created by Napkin AI

The public already recognizes these issues. In surveys, 47% of Kamloops residents cited infrequent service as the main reason they avoid transit. Others cited affordability. Making transit more frequent and affordable would address both concerns.

The Social Cost of Driving

In 2022, Gössling et al. estimated the full social cost of driving to be €0.33 per kilometre, roughly $0.524 CAD per kilometre at today’s exchange rate of 0.63 Euro per 1 CAD. For someone driving 20,000 kilometres annually, this amounts to approximately $10,000 per year in external costs, costs not borne by the driver, but by society in the form of air pollution, congestion, infrastructure wear, noise, and climate change impacts.

The Carbon Tax Repeal

On April 1, 2025, the Government of British Columbia repealed the consumer carbon tax, reducing gasoline prices by approximately 17 cents per litre. While this move was welcomed by many motorists, it also removed one of the few tools that internalized the environmental costs of fossil fuel consumption. With this repeal, the gap between the private and social cost of driving has widened, placing even greater urgency on policy tools that can support alternatives like public transit.

A Local Fuel Tax: Revisiting a 2014 Proposal

Back in 2014, I publicly advocated for a 3-cents-per-litre municipal fuel tax in Kamloops, like those in place in other Canadian cities. Metro Vancouver currently applies an 18.5 cents per litre levy to support its transit authority, while Victoria and Montreal levy 5.5 and 3 cents per litre, respectively. A 3-cents-per-litre tax in Kamloops could generate over $2 million annually, based on conservative estimates of local fuel consumption.

The fuel tax will also capture a lot of non-local revenue from travelers passing through Kamloops along Highway 1, one of Canada’s busiest transportation corridors between Vancouver and Calgary. Many of these drivers stop in Kamloops to refuel, eat, or stay overnight. This would allow the city to generate revenue from these visitors, helping to fund local public goods like transit without burdening local property taxpayers disproportionately. A decade later I am again bringing this recommendation to the attention of the local governing authority.

Conclusion

Colin Forbes’s research reminds us that a better public transit system is not a dream, it is a policy choice. Kamloops can invest in a system that is efficient, reliable, and accessible. One that reduces emissions, improves affordability, and serves the entire community. We just need the political will to treat it that way.

I invite readers to share their views: How could a better transit system improve your daily life?

References

Gössling, S., Kees, J., & Litman, T. (2022). The lifetime cost of driving a car. Ecological Economics, 194, 107335. https://doi.org/10.1016/j.ecolecon.2021.107335

Government of British Columbia. (2025, April 1). B.C. eliminates carbon tax on gasoline, diesel to provide relief for drivers [News release]. https://news.gov.bc.ca/releases/2025FIN0014-000280

Munro, R. (2022, July 24). Would busses in Kamloops, Kelowna be better if they were free? INFOnews. https://infotel.ca/inwheels/would-transit-systems-in-kamloops-and-kelowna-be-better-if-they-were-free/it92936

Tsigaris, P. (2014, April 6). Kamloops should put three-cents-per-litre municipal tax on gasoline, and tax diesel too. Armchair Mayor News. https://armchairmayor.ca/2014/04/06/kamloops-should-put-three-cents-per-litre-municipal-tax-on-gasoline-and-tax-diesel-too/

Tsigaris, P., Awad, A., Forbes, C., Izett, P., Kadaleevanam, U., Mehta, G., Noor, S., Simms, O., & Thomson A. (2024), In the Shadow of the Hills: Socioeconomic Struggles in Kamloops, TRU Open Press, https://shadowofthehills.pressbooks.tru.ca/

The city of Kamloops is conducting a survey about the fare of the transit system. See: Kamloops Transit Fare Review | Let’s Talk Kamloops

LikeLike

Correction: Victoria now charges 5.5 cents a litre. They used to charge 3.5 cents.

LikeLike

A 3-cents-per-litre fuel tax in Kamloops, while generating significant revenue ( about $2 million annually), is regressive, as it disproportionately impacts lower-income households who spend a larger share of their income on fuel. This mirrors concerns with similar taxes in Metro Vancouver (18.5¢/L), Victoria (5.5¢/L), and Montreal (3¢/L), where the burden falls heavier on those least able to afford it. This means for many families tradeoffs less food, less clothing, more pressure on housing costs less for extras for children. However, in the long run tying the revenue to public transit improvements, could offset the inequity by providing affordable alternatives to driving, especially for financially stressed residents. Without such measures, the tax risks exacerbating economic strain.

However, public transit isn’t a viable option for everyone, especially in a city like Kamloops where job locations, commutes, or schedules may not align with transit routes. A 3-cents-per-litre fuel tax would still hit those who rely on vehicles hardest, particularly low-income workers with no alternative. While the $2 million in revenue could fund transit expansion, it doesn’t immediately solve accessibility gaps. Mitigating the regressive impact might require exemptions, rebates, or investing in broader mobility solutions (e.g., carpool programs or rural transit) to better serve those outside transit’s reach.

LikeLike

Low income people and families pay little taxes in Canada. A gas tax would be offset by rebates at every quarter.

LikeLike

Pierre, tax policy is often shaped by higher earners, this doesn’t inherently make it unfair, but the outcomes here favor wealthier groups by prioritizing consumption taxes over progressive reforms which makes the policy unfair.

The tax policies, particularly the GST and PST on essential goods and services like basic clothing, household items, utilities, transportation, and food, are not fair from an equity perspective. These taxes are regressive because they disproportionately burden lower-income households, who spend a larger share of their income on these necessities.

The fact that the top 10% of income earners in Canada contribute over 50% of personal income tax revenue while earning 34% of total income highlights a progressive income tax system, but it doesn’t offset the regressive impact of consumption-based taxes like GST/PST.

For example, 12% tax on clothing/footwear, 5% GST on utilities, and taxes on basic household items, illustrate how lower-income households face a higher relative tax burden, as they have less disposable income to absorb these costs. This would include the 3% proposed in comments. Business owners deducting similar expenses further tilts the system, as lower-income individuals lack such opportunities.

LikeLike

“Kamloops relies heavily on casual drivers, many of whom work over 100 hours per week without benefits”. Please tell me this is a typo as I’m having a hard time believing that one driver let alone “many” drivers work over 100 hours a week. Driving, particularly in traffic, is tiring, a 7 day work week putting in 14hrs per day is 98 hours, are you considering on-call as part of a work week?

On the surface, I like the municipal sales tax on fuel but I’d be concerned that this would encourage travellers to bypass refuelling (and grabbing a bite to eat) in Kamloops by doing so in Chase or Merritt for examples.

LikeLiked by 1 person

Thank you for your thoughtful comment. On the question of driver hours: the reference to some casual drivers working more than 100 hours per week is based on Landry (2022). As the article states: “A second unnamed driver showed iNFOnews.ca a two-week schedule in July showing some casual drivers working more than 100 hours per week.” My editorial phrasing may have unintentionally overgeneralized this point. We’ve now updated the chapter to clarify that only some casual drivers have occasionally worked over 100 hours per week, often through frequent 12-hour shifts and skipped breaks due to staffing shortages. Thank you again for your engagement.

On the gas tax, a 3-cent municipal levy would still leave prices 14 cents lower than they were before the recent carbon tax repeal. Highway travellers usually stop when they’re low on fuel, they’re unlikely to bypass Kamloops to save a few cents, especially when prices fluctuate daily by more than that. Cities like Victoria (3.5 cents) and Montreal (3 cents) use similar taxes without seeing fuel tourism losses. The benefits to local transit and infrastructure outweigh the risks in my opinion.

References

Landry, M. (2022, July 25). Morale is terrible: Turnover at Kamloops Transit plagues both management and drivers. iNFOnews.ca. https://infotel.ca/newsitem/morale-is-terrible-turnover-at-kamloops-transit-plagues-both-management-and-drivers/it93249

LikeLike

Your reliance on some pretty shabby journalism weakens your thesis in its entirety, I find myself questioning the validity of the work. The local journalist provides no secondary source and he has a reputation of misstating the facts.

“…two week schedule in July showing some casual drivers working more than 100 hours per week. They make up for the lack of drivers by working frequent 12-hour days…”

A 12 hour work day is very taxing, 7 in a row is extremely taxing moreover it only adds up to 84 hours, where’s the other 16plus hours coming from? Furthermore, driving a bus requires a great deal of concentration, particularly in an urban setting which is increasingly draining both physically and mentally as the day and week goes by. In addition to this, the journalist states that we have multiple bus drivers who have the super human mental and physical acuity to complete this labour.

Not to mention the labour laws preventing ultra-marathon work schedules. Why would a company, particularly one that deals with the public, risk losing their gov’t contract with such flagrant disregard for the safety of both their employees and the public at large? I’m sure you see where I’m going with this.

With regards to the tax levy, every time I travel to/from Vancouver I fuel up in Chilliwack, been doing this for at least 30 years to avoid the gas levy’s, I doubt I’m the only one. Kamloops is known for having high gas prices along hwy #1, I just checked “Gasbuddy” and our prices are presently 7 cents higher than those in Salmon Arm. Truck drivers will absolutely avoid the levy if it’s too high, particularly since our prices are higher than other nearby options, so there’s obviously a tipping point which needs to be considered.

LikeLike

There are always trade-offs Mac, always.

Hence we need to decide what’s most beneficial.

LikeLike

A municipal tax on fuel is a fabulous thought which needs to be extended to include electric vehicles via some sort of conversion factor. My other thought was some sort of road tolls. I live on a street which epitomizes “middle class” mindless living, where even if a good grocery store is only about a mile away (1.6 km) no one ever walks with neither a backpack not a grocery bag. Preposterous middle class living I call it. And the mindset of this middle class (the largest constituency) is that the bus is truly the “losers’ cruiser”.

LikeLiked by 1 person