LETTER – Those who foot the bill face escalating Kamloops property taxes

(Image: Mel Rothenburger)

Mr. Rothenburger,

My wife and I moved from the Lower Mainland to my hometown of Kamloops a few years ago to be closer to family while enjoying the lower cost of home ownership. Between the friendly people, pleasant climate, and lack of traffic, we love it here! Kamloops is truly a gem!

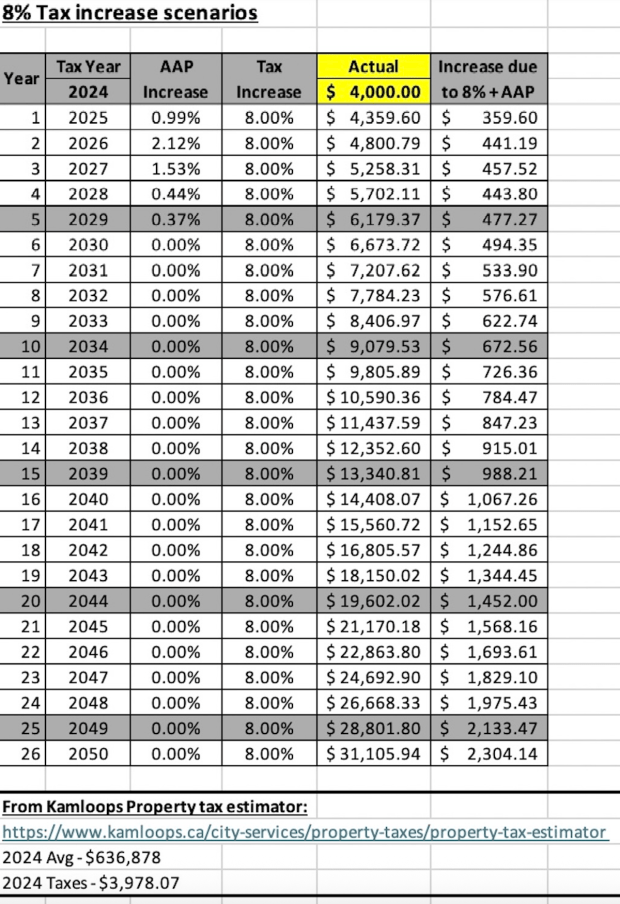

However, our annual property tax increases have averaged over 8% and with the proposed AAP projects tax increases, we are concerned about the significant tax burden we will be facing in the future.

With ongoing tax increases of 8% and our annual property tax of $4,000 in 2024, we are projected to be paying $8,400 in 2033, $16,000 in 2041 and $25,000 in 2047! As I calculate my expenses for retirement, I am anxious to be facing an annual property tax bill of over $25,000 – this will be like taking on a new mortgage! I also feel bad for new homeowners who struggle to pay their mortgages only to be blindsided with escalating property tax rates!

I’m hoping you can investigate this issue further as I have not seen anyone in the media reporting the projected tax increases or the debt burden of adding $500 million of new facilities. I am worried the current leadership at City Hall is taking the path of unchecked spending without considering who will be footing the bill long after they have left office.

Best regards,

A Kamloops Taxpayer

EDITOR’S NOTE: The letter writer attached the following spreadsheet with tax scenarios:

I added those numbers together… just so you know how much TOTAL taxes you will have paid over that time period:

$366,808.85 😆

What is the current value of your home?

LikeLiked by 1 person

Remember that the municipal tax is tied to the value of your home. Presuming an 8% per year increase, you need to include the increase in valuation of your property. It’s 8% applied to the increase of the house. Not a static increase of 8% per year. It’s far worse.

We made the decision to leave based on the high taxes and high crime. You are not getting your money’s worth in Kamloops and on top of the crime and street disorder you have the council circus to deal with. Leaving town has been a great decision for us.

LikeLiked by 1 person

And let’s not forget the $25 build back better hike per year rising to $125 per year after four yrs and staying in perpetuity nor increases to each and every utility tax and municipal fee not to mention the 5.9%, 8.3% & 7.05% TNRD tax hike in each of the past 3 years and it’s safe to say Kamloops has never seen such a tax thirsty council as we have today.

For those who may quibble about the TNRD having only 7 of 27 members from Kamloops need I remind you that tax hikes are monetary issues and all monetary issues are subject to weighted voting of which Kamloops holds 31 of 56 votes. In short, if the 7 Kamloops members don’t want it then it doesn’t go thru. But we’re talking about tax increases of which Kamloops council has shown no aversion to them.

LikeLiked by 1 person

Thanks, Mac.

I guess we can assume this is what Councillor O’Reilly, the Chair of Build Kamloops, meant when he used the word “bold”.

We voters will try to remember when O’Reilly comes to us seeking our vote for him as our next Mayor.

LikeLiked by 1 person