NATIONAL PULSE – Inflation drops but groceries and rent still a struggle

(Image: Mel Rothenburger)

Seven-in-10 renters say they can’t afford to buy a home yet (30%) or have given up on ownership (41%)

By ANGUS REID INSTITUTE

October 21, 2024 – As Canadians absorb the implications of another change in the inflation rate – down to 1.6 per cent – many are beginning to wonder what it will mean for their financial futures and pursuits of home ownership. For some, however, relief is lagging behind this key macroeconomic indicator.

Data from the non-profit Angus Reid Institute finds persistently high grocery and rental costs, which have bucked the overall downward trajectory of broader inflation, continue to put immense pressure on lower-income households. Overall, 51 per cent of Canadians say it remains a challenge to keep up with their household food needs, a proportion that has remained relatively consistent since it rose to this level in late 2021. Among those whose annual household incomes are lower than $50,000, the number having a difficult time rises to two-thirds (65%).

Overall, on the Angus Reid Institute’s Economic Stress Index, the largest proportion of Canadians are still categorized as Struggling. This, based on a measure of their self-professed financial outlook, as well as their debt, housing, and food costs. One-in-three (33%) are in this group, the same number as were in June. Smaller groups are Thriving (23%), Comfortable (22%), or Uncomfortable (22%).

There is some cause for optimism. The proportion of those saying they’re worse off now than they were 12 months ago has dropped seven points compared to last September. The number who expect to be worse off 12 months from now is also down five points compared to last year at this time.

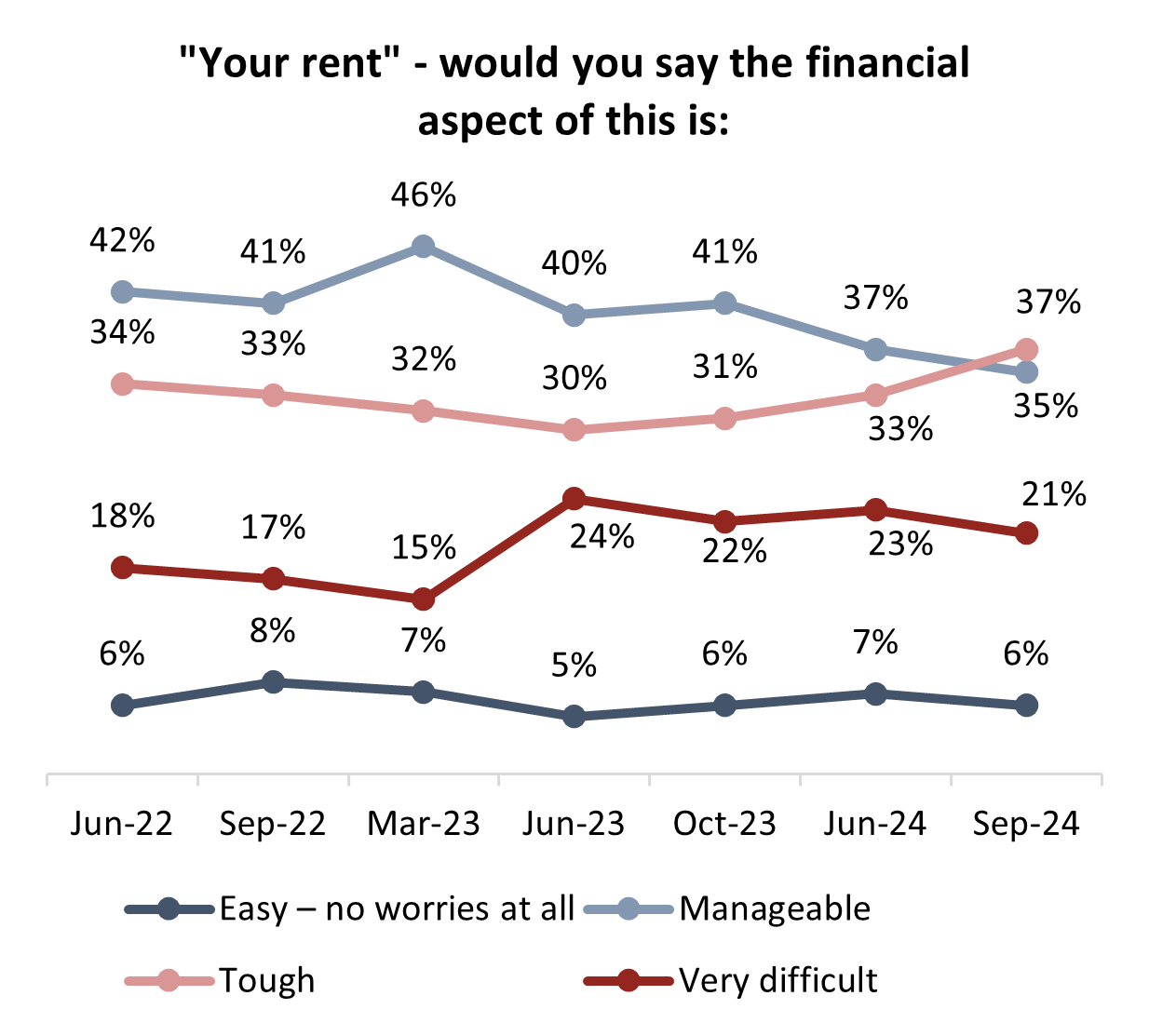

Changes in housing prices have been a mixed bag as interest rates have begun to drop. While rental costs are up overall nationwide by nearly nine per cent year-over-year, they have reportedly fallen in some key markets.

Renters, themselves, continue to have a difficult time, with three-in-five saying their monthly payment is tough or very difficult to keep up. With interest rates falling, some home-seekers are feeling energized, but for renters this is less the case. Three-in-10 say they’d like to own a home but can’t afford it yet, while two-in-five (41%) have given up on ever owning a home.

The most likely group to be looking now or waiting for rates to drop are notably those who already own multiple properties. Nearing one-in-five in this group (17%) are active now or expect to be soon, compared to 12 per cent within the group who do not own a home.

More Key Findings:

- Overall, six per cent of Canadians say they’re actively in the housing market now (whether this is for a first home or an additional property). Younger people (18-34) are most likely to say this, with one-in-10 among both men and women reporting it.

- The same number of Canadians (6%) and in each 18- to 34-year-old gender group (11% male, 9% female) say they’re waiting for mortgage rates to drop further before they engage in earnest with the home buying market.

- One-in-five Canadians expect their finances to improve over the next 12 months (20%), while 30 per cent expect the opposite. The rest expect no change (40%) or are unsure (10%).

Leave a comment