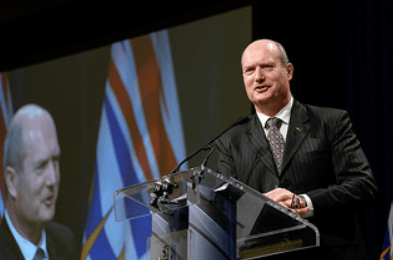

Balanced budget makes B.C. ‘enviable’ says finance minister

NEWS — Finance minister Mike de Jong introduced a budget today that calls for surpluses in all three years of the fiscal plan.

He said B.C. will end the current 2013-14 fiscal year with a $175 million surplus, with bigger ones to come.

Next fiscal will see a $184-million surplus, and that will be topped with $206 million in 2015-16 and $451 million in 2016-17, he predicted.

“B.C. is now in the enviable position of having a balanced budget this year and in all three coming years of our fiscal plan,” de Jong said.

Budget Highlights:

* Community Living B.C. receives incremental funding of $243 million over the three-year plan.

*An additional $15 million over three years for Ministry of Children and Family Development for children and youth with special needs.

*An additional $15 million over three years for increased RCMP policing costs and $6 million for legal aid-related services.

*Funding of $29 million over three years to support the development of an LNG industry in B.C., including attracting investments to B.C.

De Jong noted that the new NorKam Trades Centre of Excellence, scheduled for completion this fall, will offer courses in mining exploration, industrial skills and construction trades training.

The B.C. Chartered Professional Accountants said the budget is heading in the right direction but has room for improvement when it comes to creating a more competitive investment climate.

“The loss of input tax credits through the re-introduction of the PST in 2013 increased costs to business by $1.5 billion, and has led to decreased investment in the province over the short term, and will impact productivity and job creation over the long term,” said Richard Rees of the CPABC.

Starting in April 2015, the new B.C. Early Childhood Tax Benefit will provide $146 million annually to about 180,000 families with children under the age of six (up to $55 a month per eligible child). About 90 per cent of B.C. families with young children will be eligible.

De Jong said many British Columbians buying their first home will pay less property transfer tax because the province is increasing the threshold for the first-time homebuyers program to $475,000 from $425,000, an exemption that can save the purchaser up to $7,500 when buying their first home.

The Ministry of Health budget will increase $2.5 billion over three years. Total health spending by function will reach $19.6 billion, or more than 42 per cent of all government expenses by 2016-17.

Taxes on tobacco will increase by 32 cents per pack, or $3.20 a carton, effective April 1, 2014. The increase is expected to generate an additional $50 million in annual revenue over the course of the fiscal plan.

Income-tax legislation will be introduced later this year on the LNG industry.

It will be a two-tier tax with a tier-one tax rate of 1.5 per cent and a tier-two rate of up to seven per cent, with the final rates to be determined and confirmed in legislation. The tax will apply to income from liquefaction of natural gas at LNG facilities.

“Our LNG income-tax-revenue framework strikes the right balance between the need to maximize the return to British Columbians, while also ensuring B.C. is an attractive and competitive place to develop LNG,” said de Jong.

Capital spending on schools, hospitals and other infrastructure across the province over the next three years is expected to total $11 billion.

Leave a comment